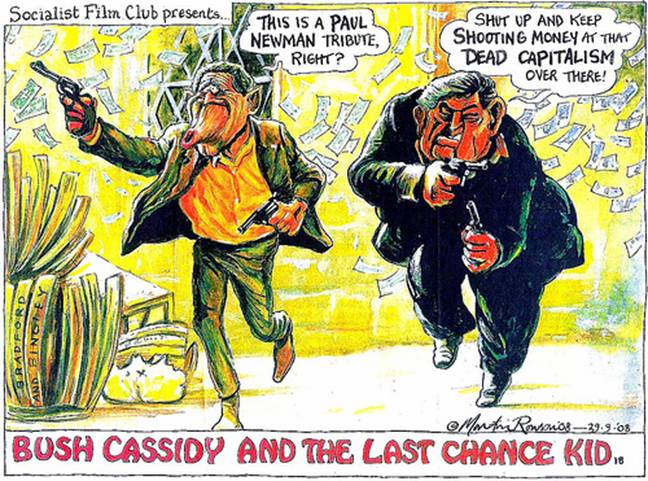

Martin Rowson publishes cartoons in The Guardian

Eleven years after the Asian financial tail-spin and twenty since a flight of funds cut 30% off stock prices, central bankers are running up warning flags about the fragility of their global system. As far back as June last year, the International Bank of Settlements raised the stakes by using the D-word - a Depression of 1930s dimension - not just a recession like that of the late 1970s.

Returning from two years in Tokyo in April 1990, I waited for the bursting of its real-estate and stock-market Bubbles to torpedo the world economy. Instead, Japan’s technocrats navigated through a protracted deflationary cycle by ignoring the advice of free-market economists to deliver a short sharp shock of the kind with which Jeffrey Sachs was harrowing post-Soviet Russia.

Having got Japan wrong, and not keen to join those commentators renowned for predicting eight of the last three recessions, I stopped asking “When will capitalism collapse?”, instead, pondering the question “Can capitalism collapse?”

Whatever happens next will not be a replay of the 1930s.

The first obvious difference from the 1930s is that the world economy is now several times larger. The force needed to stop its expansion will have to be that much larger than it was around 1930-32. The momentum of the current system might allow it to keep from stalling while growing at a lower rate.

Connected to this increased in size is that the global order now has three principal centers, Europe, North America and East Asia, against three halves 80 years ago. In the last 15 years, the global economy has sometimes got by on a single engine until at least one of the others restarted.

Two points of similarity with the 1920s remain. The first is that the Wall Street Crash of October 1929 was a symptom of the depression, not its cause.

The flood of funds into the stock market had followed the drying up of opportunities to gain average rates of return from investing in the production of surplus value. One instance of this over-supply today is that, were all the car plants in North America to close down, the auto factories in the rest of the world would be able to roll out more vehicles than there is credit to buy them (i.e., “effective demand”). Also like then, any tripwire will be in the financial sector because its bubbles have resulted from the latest bout of excess manufacturing capacity. The sub-prime crisis is not infecting the physical economy. That is where it started.

On top of these objective factors comes a psycho-sociological reason why the triggers for another depression will not replicate October 1929.

Too many people are watching that possibility. Danger spots erupt wherever no one with the power to act is looking. The cliché that those who forget the past are condemned to repeat it forgets that those who are fixated on a version of the past are condemned to be run down because new things keep happening. That’s dialectics for you.