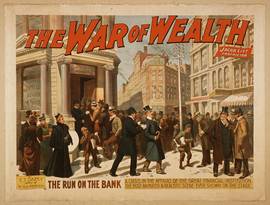

1929 Crash on Wall Street depicted as theatre

When the radio news reported that the New York Stock market had “lost” a trillion dollars, my eyes glazed over.

A trillion is what Douglas Hofstader calls a Very Big Number, meaning that we have no way of coping with so many zeros after the one ($1,000,000,000,000). Those Arabic symbols might as well be in Roman numerals for all the use they are. According to Hofstader, the newsreader might as well have said “zillions”, for all the information that “trillion” conveys.

Those noughts add up to a sense of hopelessness. Therefore, the development of the class struggle, or a retirement plan, requires that we deflate the Very Big Numbers. The way of doing so is to puncture that non-doing word, “lost”.

We understand what it means to lose a wallet or a purse. We also know that those objects almost certainly still exist somewhere. It’s just that we cannot put our hands on them for the moment. One little difference is that the trillion dollars no longer exist because - and this is the key - they never did.

The “value” put on each company’s stock is determined by the latest bid price for one of its shares, multiplied by the number of shares issued. The “value” of the entire stock market, in turn, is calculated by multiplying the prices paid for the fraction of shares traded each day by the total number of shares of all listed firms.

Take a homely contrast. In the first case, you have paid $300,000 of your earnings into your industry super fund. The market plummets and you have to retire on $200,000. You have indeed lost at least $100,000. Now, consider this alternative. While you were buying $300,000 worth of super, its realisable value went up to $600,000. Had you cashed it in, you would have made $300,000. But, alack, the market collapsed before you go grey-nomading so that you have to live off only $500,000. You feel as if you have lost $100,000, although that is money you never paid out. (OK, OK, there were also opportunity costs.)

For many traders, the trillion dollar loss was also on paper. Of course, there are some real losers, those who did not find a Greater Fool to buy them out in time.

On Monday, New York went down by a trillion, then, on Tuesday, it went back up by $600bn. That bounce was not from the influx of $600bn of capital. After all, the justification for the $700 billion bailout is that those sums are not available.

All that happened was that enough bargain-hunters bought just enough shares at a marginally greater price than the day’s before so that when those handful of bids were multiplied by all the shares, they added up to $600bn.

Had everyone offered to sell all of their shares on either day, all the stocks would be worthless. The bailout and nationalisations are to deter investors from fleeing into bonds or gold.

Should that happen, the aged pension will be cut by $30.

Next: McValue